Subsequently, You will find arrived a good jobs and you can I have already been making steady money on the paying down my student loan . Is it possible personally to order property whenever you are I’m still paying down that it personal debt?

A : Positively! Dealing with student loan debt responsibly cannot stop you from to shop for a beneficial domestic . This is what you need to imagine therefore the steps when deciding to take ahead of time house-query.

Pick should be to determine if homeownership aligns together with your current lifetime needs . Evaluate these things carefully before generally making your decision.

Once you choose that to invest in a home suits you, work at boosting your credit rating

- Place, Location, Place : Are you currently particular concerning the town or neighborhood we would like to accept in? Early in your job, autonomy is key. Renting could offer new freedom to maneuver to own occupations https://paydayloancolorado.net/otis/ rather than the trouble regarding selling a house.

Once you determine you to definitely to buy property is right for you, work at enhancing your credit history

- Financial Readiness : Are you safe taking on another essential financial commitment? A mortgage is a significant duty, and you will have to care for a strict funds to manage one another the college loans and you will mortgage repayments.

After you pick that purchasing a house suits you, work at enhancing your credit score

- Pay the bills promptly : Create automated payments to make certain that you do not miss a due day.

Once you determine one to to acquire a property is right for you, focus on boosting your credit score

- Remain Borrowing Use Lowest : Select below 31% of available borrowing from the bank.

When you pick one to order a home suits you, work at boosting your credit rating

- Shell out Credit cards completely : Pay off the stability just before they’ve been due.

After you select one to purchasing property is right for you, run enhancing your credit history

- Maintain Credit history : Stop closure old profile otherwise beginning brand new ones, since these procedures can lessen the mediocre borrowing from the bank age.

Of many younger students accept that education loan obligations will make it difficult to find home financing. A recently available questionnaire off MarketWatch Instructions indicated that 46% of recent school grads in the us which have figuratively speaking defer to find a home with regards to personal debt. not, a proper-treated student loan shouldn’t be a buffer.

Once you decide you to purchasing a home suits you, work on enhancing your credit history

- Establish Automated Money : Guarantee punctual student loan payments.

After you determine one to buying property is right for you, work on enhancing your credit score

- Lower your Financial obligation-to-Income (DTI) Proportion : Essentially, the overall obligations money, together with your home loan, can be below thirty six% of earnings. Should your DTI is just too large, envision refinancing their student loans to lessen their rates, otherwise come across an effective way to improve your earnings.

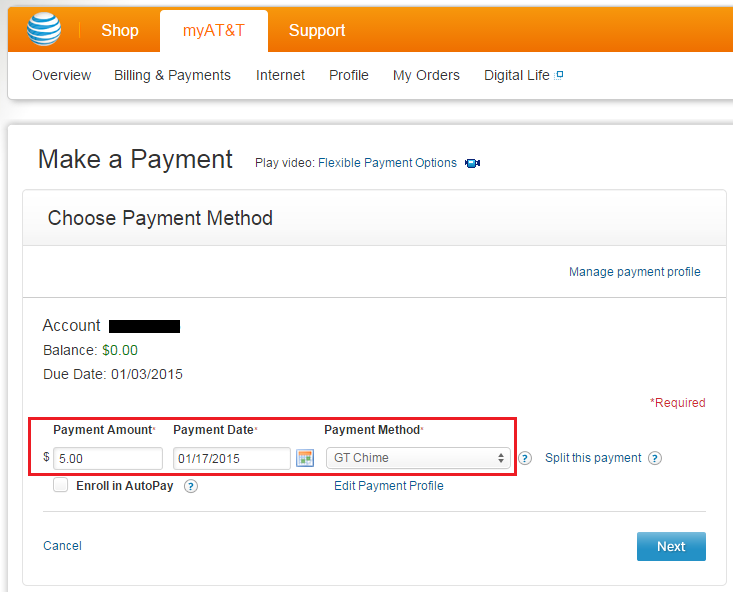

In advance of house-query, score a very clear picture of your budget. Obtaining a good preapproval of a lender, particularly Scott Credit Union , can provide a realistic price variety and you may show sellers one to you happen to be a significant buyer. If you’re not ready having preapproval however, wanted a rough estimate, explore an internet financial calculator to guage your finances.

Along with your funds in your mind, start preserving having a deposit. Cut a lot of expenses and talk about front side hustles to improve the savings . You may also developed an automated monthly move into their Scott Credit Commitment family savings to enhance their coupons with ease.

Scott Borrowing from the bank Commitment also provides different loan choices to assist you on your family-purchasing journey. Imagine the competitive mortgage programs, in addition to those with low-down repayments and you may a beneficial 100% financial capital choice for certified consumers. The educated Mortgage Originators normally direct you from finest solutions for the state, guaranteeing the truth is just the right complement debt demands.

When you’re ready to purchase property, contact Scott Borrowing Union to get started in your home-to find travel. Which have aggressive cost and you can a simple preapproval procedure, a Scott Borrowing from the bank Partnership financial was a pretty wise solution!

By using this type of strategies, you could potentially navigate the journey of purchasing a property if you are handling education loan loans. Start making plans for your future today!